原文来自YettaS的文章,此处作译自留。

A truly native innovation is something that didn’t exist before and only becomes possible with the emergence of a new technological paradigm. In Web3, we’ve long been asking: what makes an innovation truly native to the crypto stack?

所谓真正原生的创新是某种前所未有、只在新技术范式出现后才可能诞生的事物。在 Web3 领域,我们长久以来都在询问:究竟什么才称得上是加密技术领域中的原生创新?

Fred Wilson offers a timeless framework in his 2009 article The Mobile Challenge:

2009年投资家弗雷德·威尔逊在其文章《移动端的挑战》中提供了一个永不过时的框架:

By “native” we mean opportunities that simply did not exist previously and cannot exist without the phone. For instance, we would not consider delivering breaking news to a mobile a native opportunity, as a startup rarely has a better chance of being “CNN for mobile” than CNN does.

我们所说的“原生”,指的是那些在过去根本不存在,且离开手机便无法存在的机会。例如,我们不会将向移动设备推送突发新闻视为一个原生机会,因为一家初创公司想要成为“移动端的CNN”,其胜算很难超过CNN自己。

The insight is sharp: true nativeness emerges only when a new interface fundamentally reshapes how we interact with systems. If we apple this principle to Web3, I would argue that stablecoins, especially through the lens of payments and banking, are one of the most native innovations in crypto.

这个洞见十分犀利:真正的原生性,只在一种新的交互界面从根本上重塑了我们与系统互动的方式时,才会涌现。 如果我们将此原则应用于 Web3,我认为稳定币正是加密世界最原生的创新之一,特别是从支付和银行业的视角。

Interface Shifts Create Aggregation Opportunities

交互界面的变迁,创造聚合的机遇

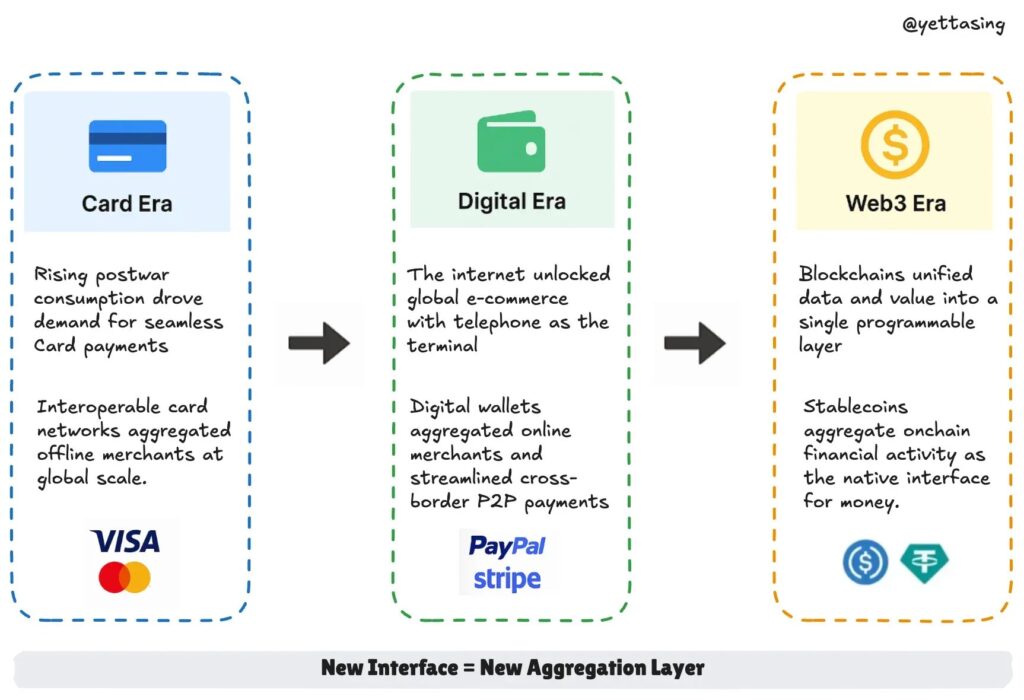

Every transformation in finance begins with a new user interface. These interfaces introduce friction early on, but they also open aggregation opportunities by redefining how value is initiated, verified, and settled.

金融领域的每一次变革,都始于一种新的用户界面。这些界面在初期会带来一些摩擦,但它们通过重新定义价值的“发起、验证与结算”方式,也开启了巨大的聚合机遇。

- In the Card Era, the credit card became the new interface for cash.

卡片时代:信用卡成为了现金的新界面。 - In the Digital Era, digital wallets became the new interface for e-commerce.

数字时代:电子钱包成为了电子商务的新界面。 - In the Web3 Era, stablecoins are becoming the new interface for bank.

Web3 时代:稳定币正在成为银行的新界面。

Card Era: Visa and the Birth of the Global Network

卡片时代:Visa 与全球网络的诞生

Post-WWII America saw rising incomes and booming consumption. As consumers demanded more seamless payments, credit cards emerged. Diners Club led the charge in 1950, followed by Amex and MasterCard.

二战后的美国,收入增长,消费蓬勃。随着消费者对更无缝支付方式的需求日益增长,信用卡应运而生。1950年,大来卡一马当先,随后美国运通和万事达卡也纷纷入局。

But early systems were siloed. A card from one bank might not work with a merchant using another network. There was no true interoperability.

但早期的系统是孤立的。一家银行的卡,可能无法在另一家银行网络的商户处使用,缺乏真正的互操作性。

In 1958, Bank of America launched BankAmericard, a scalable system that used licensing to interconnect banks and merchants. By 1976, it became Visa, a global network that aggregated fragmentation into a universal layer.

1958年,美国银行推出了“美国银行卡”,这是一个通过授权许可模式将各家银行与商户连接起来的可扩展系统。到1976年,它演变成了 Visa,一个将碎片化的市场聚合成一个通用的全球网络。

Digital Era: Paypal and the Interface for Online Commerce

数字时代:PayPal 与在线商业的界面

The late 1990s redefined commerce with the rise of eBay and the explosion of cross-border, P2P trade. But payments lagged behind. Buyers needed a way to transact without sharing card info or dealing with FX and remittance friction.

上世纪90年代末,eBay的崛起和爆炸式增长的跨境P2P贸易重新定义了商业,但支付方式却相对滞后。买家需要一种无需共享信用卡信息,又能避开外汇兑换和汇款摩擦的交易方式。

PayPal quickly pivoted to dominate online payments. With email-based transfers and instant account onboarding, it reduced friction and embedded itself into the internet-native economy.

PayPal 迅速转型,主宰了在线支付领域。凭借基于电子邮件的转账和即时开户功能,它极大地降低了交易摩擦,将自己深度嵌入到互联网原生经济之中。

Web3 Era: Stablecoin as Interface for Value Movement

Web3 时代:稳定币作为价值流动的界面

So what’s truly native in Web3? In this paradigm, data is money, and money is data.

那么,在 Web3 中,什么是真正的原生创新?在这个范式里,数据即金钱,金钱即数据。

Legacy systems separate information and value. SWIFT sends payment instructions; settlement happens later, through a maze of Correspondent banks and clearinghouses. It’s slow, costly, and opaque.

传统系统将信息流与价值流分离开来。SWIFT 系统发送的是支付指令,而资金的最终结算则需要通过代理行和清算所组成的迷宫,在晚些时候才能完成。这个过程缓慢、昂贵且不透明。

Blockchain merged information and value into a single layer. Now, value moves like information. This unlocks a design space for programmable, composable finance:

区块链将信息与价值融合到了同一个层面。现在,价值可以像信息一样流动。这为可编程、可组合的金融解锁了一个全新的设计空间:

- Trustless: every transaction is verifiable on-chain

去信任化:每笔交易都在链上可验证。 - Permissionless: anyone can build and use financial services

无需许可:任何人都可以构建和使用金融服务。 - Interoperable: assets can flow across protocols and chains

互操作性:资产可以在不同协议和链之间自由流动。

Stablecoins sit at the heart of this. They’ve become the native interface for depositing, earning, borrowing, and spending in the crypto economy, effectively functioning as a new kind of bank interface.

稳定币正是核心。它们已成为在加密经济中进行存款、赚取收益、借贷和消费的原生界面,有效地扮演了一种新型银行界面的角色。

From Interface to Network: Stablecoin as the New Liquidity Layer

从界面到网络:稳定币成为新的流动性层

Like cards before Visa, stablecoins today are fragmented, issued by different players with varying strategies and backends. But they all compete to become the default liquidity layer of crypto’s financial stack.

如同 Visa 诞生前的信用卡市场,今天的稳定币也呈现出碎片化的格局,由不同的参与者发行,各有其策略和后端支持。但它们都在竞相成为加密金融体系中默认的流动性层。

So we can see the giants are moving in:

我们可以看到巨头们已经开始行动:

- Ripple acquired Hidden Road for $1.25B to push RLUSD into institutional markets.

Ripple 以12.5亿美元收购了 Hidden Road,旨在将 RLUSD 推向机构市场。 - Circle launched a B2B-focused settlement layer via Circle Payments Network.

Circle 通过 Circle Payments Network 推出了一个专注于B2B的结算层。 - Mastercard is building end-to-end stablecoin rails with OKX.

Mastercard 正在与 OKX 合作,构建端到端的稳定币支付通道。 - Visa partners with Bridge to power stablecoin-linked card infrastructure.

Visa 与 Bridge 合作,为与稳定币挂钩的银行卡基础设施提供支持。 - Stripe introduces stablecoin-native accounts for global developers and merchants.

Stripe 为全球开发者和商户引入了稳定币原生账户。

No one wants to miss the next big aggregation moment.

没有人愿意错过下一个巨大的聚合时刻。

Toward Narrow Banking and Deposit Flight

走向“狭义银行”与存款外流

The Senate’s passage of the Genius Act clears the way for tradfi to issue stablecoins, opening the door for more tradfi institutions to enter the stablecoin space. But in the long term, it sets the stage for a deposit flight from traditional banks. If users can earn, store, and spend on-chain with assets that yield and settle instantly, why leave money in a bank?

美国参议院通过的《天才法案》为传统金融机构发行稳定币扫清了道路,为更多传统金融力量进入稳定币领域打开了大门。但从长远来看,这也为传统银行的存款外流埋下了伏笔。如果用户可以在链上持有、消费那些既能生息又能即时结算的资产,为什么还要把钱留在银行?

Traditional banks may evolve into mere ATMs, on/off ramps for programmable dollars. An interesting case here is @fraxfinance, which is actively building frxUSD into a universal, interoperable base layer across regulated fiatcoins.

传统银行可能会演变为单纯的自动取款机,即可编程美元的出入金通道。这里一个有趣的案例是fraxfinance,它正积极地将 frxUSD 构建成一个跨越各种受监管法币的通用可互操作基础层。

Just like PayPal siphoned volume from processors, stablecoins could begin draining deposits from banks. The future may be a narrow banking regime, where banks hold custody and run rails, but credit creation moves elsewhere.

正如 PayPal 从支付处理商那里分流了交易量,稳定币也可能开始从银行吸走存款。未来可能会出现一个“狭义银行”的格局:银行只负责托管和运营通道,而信贷产生则转移到其他地方。

The Golden Triad of Stablecoin

稳定币金三角

As stablecoins evolve from trading chips into the native interface for depositing, earning, borrowing, and spending across the crypto economy, they begin to resemble a new kind of digital liquidity layer – programmable, composable, and global by default.

随着稳定币从交易筹码演变为加密经济中存款、赚息、借贷和消费的原生界面,它们开始呈现出一种新型数字流动性层的默认特征——可编程、可组合以及全球化。

But becoming the default money layer isn’t just about trust or speed. It requires solving three hard problems which was solved by traditional banks through infrastructure, regulation, and scale.

但要成为默认的货币层,仅仅依靠信任或速度是远远不够的。它需要解决传统银行通过基础设施、监管和规模才得以解决的三大难题。

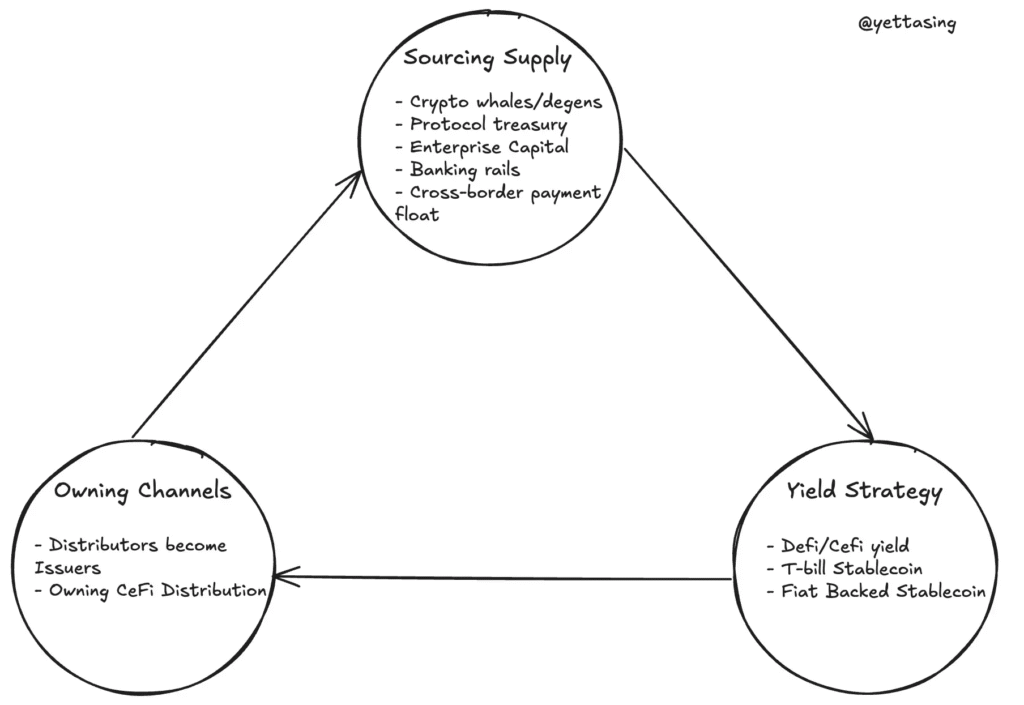

In crypto, this comes down to mastering the Golden Triad of Stablecoin Strategy:

在加密世界,这归结为掌握稳定币的金三角战略:

- Sourcing Supply – Where will the stablecoin’s liquidity come from? Can you tap deep, idle capital pools quickly and credibly?

供给来源 – 稳定币的流动性从何而来?你能否快速、可信地挖掘到深度的闲置资本池? - Owning Channels – How will the stablecoin get used? Do you control key distribution points like CEXs, brokerages, or web2 use case?

渠道为王 – 稳定币将如何被使用?你是否掌控着关键的分发节点,如中心化交易所、券商或 Web2 应用场景? - Designing Yield – Can you create scalable, modular yield strategies that align with users, partners, and regulators?

收益设计 – 你能否创造出可扩展、模块化的收益策略,并使其与用户、合作伙伴及监管机构的利益保持一致?

Most stablecoin projects get one right. Some get two. The winners will be those who triangulate all three.

大多数稳定币项目能做好其中一点,有些能做到两点。最终的赢家,将是那些能够将三者完美结合的选手。

1. Sourcing Supply: The Fight for Idle Capital

1. 供给来源:闲置资本争夺战

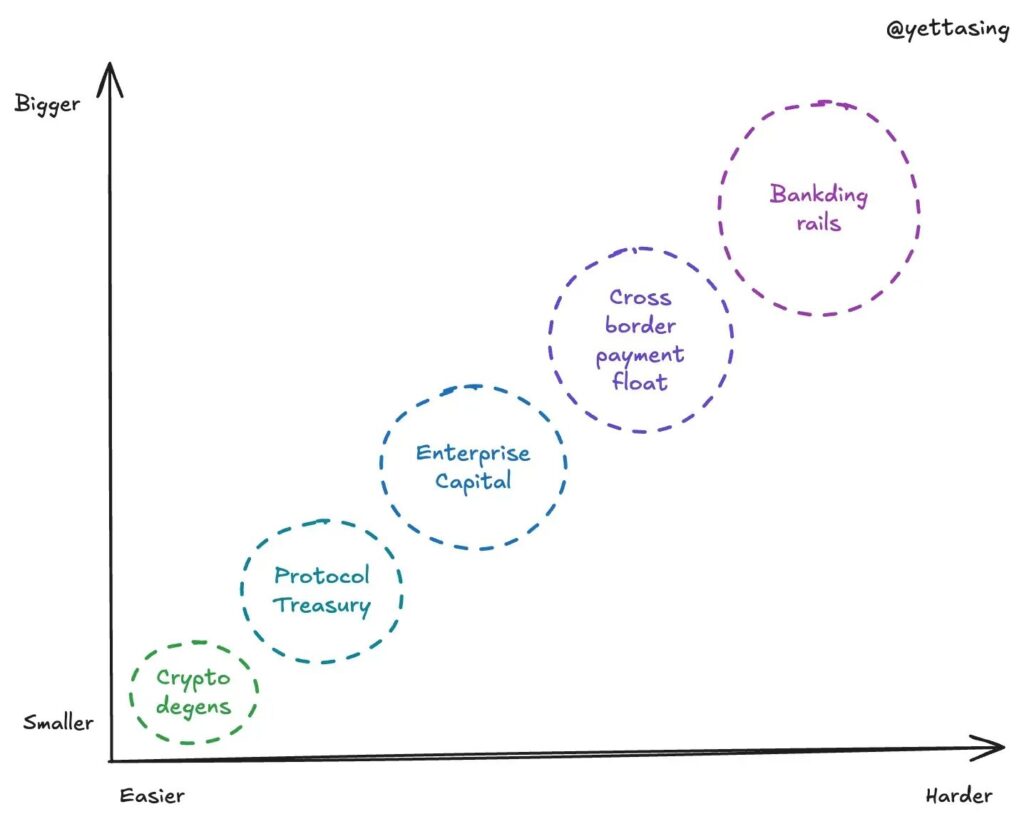

The winners in stablecoins are those who unlock trapped dollars first. Supply is not infinite, it’s a speed game to capture deposits from the biggest, most underutilized pools. Here’s where the race is happening, from easier to harder, from smaller to bigger.

稳定币的赢家,是那些率先解锁被困资金的人。供给并非无限,这是一场争夺最大、最未被充分利用的资金池的竞速游戏。这场竞赛正从易到难、从小到大依次展开。

- Crypto whales/degens: Still the fastest-moving source for crypto-native models like @ethena, bootstrapped by whales, degens, and margin traders on CEXs and DeFi.

加密巨鲸/散户:对于像 ethena 这样的加密原生模型而言,由巨鲸、散户和中心化交易所及DeFi上的保证金交易者提供的初始资金仍然是最快的来源。 - Protocol Treasuries: Massive and sticky. @buidlfi holds $2.8B TVL with just 69 wallets, the top two being @ethena_labs and @SkyEcosystem. Stablecoins are becoming reserve assets for crypto-native institutions.

各种协议的国库:规模巨大且粘性强。buidlfi 仅凭69个钱包就实现了28亿美元的总锁仓价值,其中最大的两个来自 ethena_labs 和 SkyEcosystem。稳定币正成为加密原生机构的储备资产。 - Enterprise Capital: From RWA projects to regional fintechs, everyone’s chasing corporate treasuries and remittance networks to issue or integrate stablecoins. @USDX is gaining early traction here.

企业资本:从真实世界资产项目到区域性金融科技公司,所有人都在追逐企业财库和汇款网络,以发行或集成稳定币。USDX 在此领域已获得早期关注。 - Cross-Border Payment Float: Stablecoins are now the #2 global payment rail by volume. The trapped liquidity in crypto’s interoperable settlement layer becomes a natural float source. Bullish on @codex.

跨境支付浮存金:按交易量计算,稳定币现已是全球第二大支付通道。加密世界可互操作结算层中沉淀的流动性,自然成为了浮存金的来源。看好codex。 - Banking rails: Post-Genius Act, banks can natively interact with stablecoin infrastructure. @fraxfinance is among the first to move into this lane.

银行通道:在《天才法案》之后,银行可以原生方式与稳定币基础设施互动。fraxfinance 是首批进入该赛道的项目之一。

2. Owning Channels: Where Distribution Becomes Destiny

2. 渠道为王:分发决定命运

Distribution is the moat. Whoever owns the last-mile user experience, wallet, CEX, brokerage, or merchant network, locks in usage and defensibility.

渠道即护城河。谁掌握了最后一公里的用户体验——无论是钱包、中心化交易所、券商还是商户网络——谁就锁定了使用场景和防御能力。

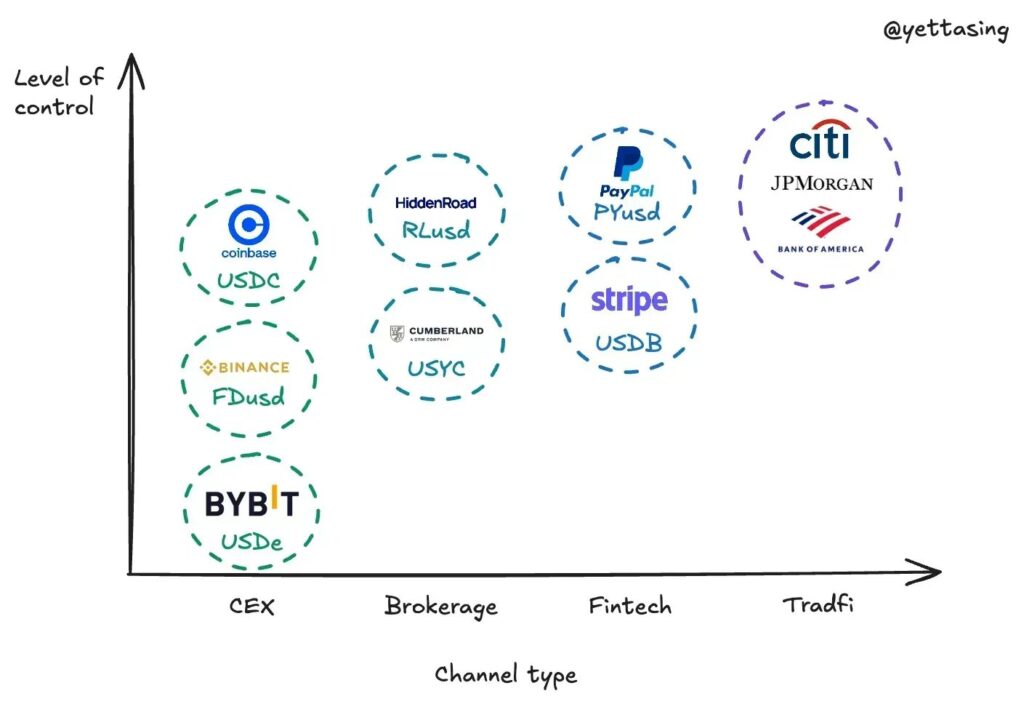

Two dominant strategies are emerging:

两种主流策略正在形成:

Distributors become Issuers

分销商成为发行商

- @PayPal launched $PYUSD to natively monetize its payments ecosystem

PayPal 推出 PYUSD,以原生方式将自己的支付生态系统变现 - @stripe launched Stablecoin Financial Accounts supporting USDB issued by Bridge

stripe 推出稳定币金融账户,支持由 Bridge 发行的 USDB - @CumberlandSays’s affiliate @Hashnote_Labs launched USYC, a yield-bearing stablecoin backed by U.S. Treasuries

CumberlandSays 的关联公司 Hashnote_Labs 推出了 USYC,一种由美国国债支持的生息稳定币 - JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo, are exploring a joint stablecoin

摩根大通、美国银行、花旗集团和富国银行正在探索联合发行稳定币

Owning CeFi Distribution

掌控中心化金融分销渠道

- @coinbase is the key distribution engine behind @circle’s USDC

coinbase 是 circle 的 USDC 背后关键的分销引擎 - @Binance pushed $FDUSD to replace $BUSD, now its internal settlement token

Binance 大力推广FDUSD以取代BUSD,使其成为内部结算代币 - @ethena_labs bootstrapped USDe adoption by plugging directly into @Bybit_Official

ethena_labs 通过直接接入 Bybit_Official,快速启动了USDe的采用 - @Ripple acquired Hidden Road to build deep into institutional brokerage plumbing

Ripple 收购 Hidden Road,旨在深入构建机构券商的基础设施

3. Yield Strategy: Designing the Stablecoin Yield Curve

3. 收益策略:设计稳定币的收益曲线

Beyond trust and liquidity, stablecoins compete on how they monetize float. But yield design faces a classic tradeoff: higher returns limit scalability.

除了信任度和流动性,稳定币的竞争还体现在如何利用浮存金来创造收益。但收益设计面临一个经典的权衡:高回报率会限制可扩展性。

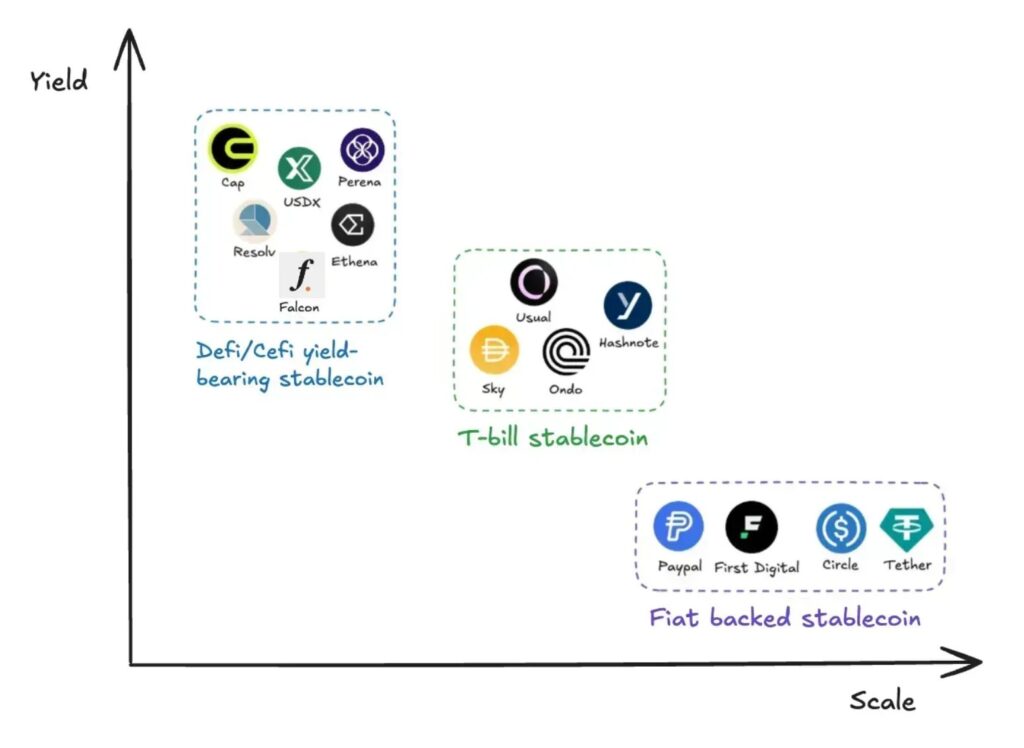

The current landscape clusters into three strategic zones:

当前的市场格局可分为三大战略区域:

DeFi/CeFi Yield-Bearing Stablecoins: These protocols attract capital by offering high yields, often through creative financial engineering. However, their ability to scale is constrained by two core challenges: risk management and regulatory complexity.

DeFi/CeFi 生息稳定币:这些协议通过提供高收益来吸引资本,通常采用创新的金融工程手段。然而,它们的扩展能力受到两大核心挑战的制约:风险管理和监管复杂性。

- Ethena, which began with delta-neutral strategies to generate yield for its synthetic dollar USDe, has since expanded into asset management and payment solutions, offering a comprehensive DeFi platform.

Ethena:最初通过 Delta 中性策略为其合成美元 USDe 创造收益,现已扩展到资产管理和支付解决方案,提供一个全面的DeFi平台。 - Perena is a Solana-based stablebank that partners with external vault managers to diversify yield sources for its users.

Perena:一个基于 Solana 的稳定币银行,与外部金库管理者合作,为用户实现收益来源的多样化。 - CAP is a DeFi protocol that incorporates restaking to secure its ecosystem while involving Franklin Templeton as a key asset manager to generate yield for stablecoin holders.

CAP:一个采用再质押来保障其生态系统安全的DeFi协议,同时引入富兰克林邓普顿作为关键资产管理者,为稳定币持有者创造收益。 - Resolv is expanding from its original delta-neutral strategy to capitalizing on a broad range of crypto yields, using its risk-segregation mechanism (through RLP token) to ensure stability and institutional adoption.

Resolv:正从其最初的 Delta 中性策略扩展至利用更广泛的加密收益,通过其风险隔离机制(RLP代币)确保稳定性和机构采纳。 - Falcon: backed by DWF Labs, is a synthetic dollar protocol that employs a unique reverse delta neutral approach.

Falcon:由 DWF Labs 支持,是一个采用独特的反向 Delta 中性策略的合成美元协议。 - StableLabs offers USDX, a synthetic USD stablecoin that employs a multicoin arbitrage strategy as backing, maintaining a delta neutral approximate dollar position through balanced trading across various digital assets.

StableLabs:提供合成美元稳定币 USDX,采用多币种套利策略作为支持,通过在各种数字资产间进行平衡交易来维持近似于美元的 Delta 中立头寸。

T-Bill Stablecoins: Moderate yield, institutional-grade structure. Players like Ondo and Hashnote tokenize U.S. Treasuries via MMFs, striking a balance between compliance and composability.

短期国债稳定币:中等收益,机构级结构。像 Ondo 和 Hashnote 这样的参与者通过货币市场基金将美国国债代币化,在合规性与可组合性之间取得了平衡。

Fiat-Backed Stablecoins: No yield, maximum scale. USDC, USDT, FDUSD, and PYUSD offer distribution dominance through CEXs and payment rails, monetizing float off-chain with minimal user incentives.

法币支持的稳定币:无收益,但规模最大。USDC、USDT、FDUSD 和 PYUSD 通过中心化交易所和支付通道提供分销优势,在链下利用浮存金变现,同时向用户提供极少的收益。

Just as Visa abstracted merchant banking relationships into a universal settlement layer, stablecoins now abstract away the deposit layer of banks—turning money into an open API.

This changes the interface of banking itself.

And in that interface shift lies the opportunity: To rebuild the monetary stack from the ground up, with stablecoins as the core operating system.

正如 Visa 将商户与银行的关系抽象成一个通用的结算层,稳定币如今也正在将银行的存款层抽象出来——将货币转变为一个开放的API。

这改变了银行业本身的界面。

而就在这场界面变革之中,蕴藏着一个巨大的机遇:以稳定币为核心操作系统,自下而上地重建整个货币体系。

发表回复